Cheapest Silver Bullion Price. The Silver bullion products listed here have the lowest premium over silver spot price per ounce. These are the cheapest silver prices offered by major online bullion dealers with the lowest silver premium. When you're looking to buy silver.

- Are Silver Coins Worth Money

- Silver Coin Price Today In Kanpur

- Best Silver Coin Prices

- Silver Coin Spot Price Today

- Conversion Silver Price(Spot) Price; 1 Troy Ounce ≈ 31,10 Gram Silver Price Per 1 Gram 0.86 USD 1 Troy Ounce ≈ 0,031 Kilogram.

- Instant access to 24/7 live gold and silver prices from Monex, America's trusted, high volume precious metals dealer for 50+ years. Call 800-997-7859 to invest in gold and silver bars & coins with Monex.

- Update with silver rate today (7th February 2021) & last 10 days silver price in India, based on rupees per gram/kg in major Indian cities.

In a time of coronavirus induced economic instability — making the RIGHT investment choices is crucial to long-term portfolio success.

Right now the market indexes are in a state of turmoil, with volatile investor sell-off motivated insanity. Traditional forms of investing have seen the tailwind of a depression.

I’ve been observing trends in our economy and using it to our reader’s favor for years, and today, I’m going to share my observations on the Best Silver Coins to Buy for Survival.

As always I’ll make sure you’re well informed before purchasing this precious metal. and I'll let you know whether you should buy silver bars or coins in this climate.

While it’s all too easy to jump headfirst into an investment nowadays without committing to due diligence, facing up to the task of educating yourself on the matter will make you a better Investor and it may just save your portfolio.

This is one article you seriously DON’T want to miss on the most popular silver coins!

Check it out below and let me know what you think in the comments?

Here at Personal Income, we're huge advocates of Long term investments that can yield great profit. Silver coins have become an excellent way to expand assets.

However, many aren't sure where to turn to get the best bang for their buck. These are the purest silver coins to buy in 2020 as a long term investment.

If you want to check real-time prices for these and see pictures of silver coins check out the professionals at Money Metals Exchange. I’ve been using them for years and they have the lowest prices for silver coins on the market today.

No matter what silver coin you invest in, make sure that it contains REAL silver. The higher the volume of silver in the coin, the more it will be worth long term in your portfolio. You can verify authenticity of silver bars or coins by investing with a verified US Coins dealer like Money Metals Exchange above.

1. Monarch Precious Metals 1/10oz Silver Rounds

This coin is small but never underestimate a 'small' coin. This silver coin can add great value. These are great for trade at One-tenth of an once. Breaking down coins isn't always recommended because of how expensive things can get but these can be a great part of a collection of valuable silver.

2. Morgan Silver Dollars

These coins are U.S. legal tender. Minted from 1878 to 1904 and again in 1921 for a year, they are 90% silver and 10% copper. They were minted again for a year in 1921.

3. Mexican Silver Libertads

These are beautifully made coins that are issued in Mexico. They can be a good opportunity but may not be the best compared to other government coins. With that being said, they are one of the purest silver coins that have some value. They are a bit expensive compared to others on this list but the craftmansip within this coin is remarkable.

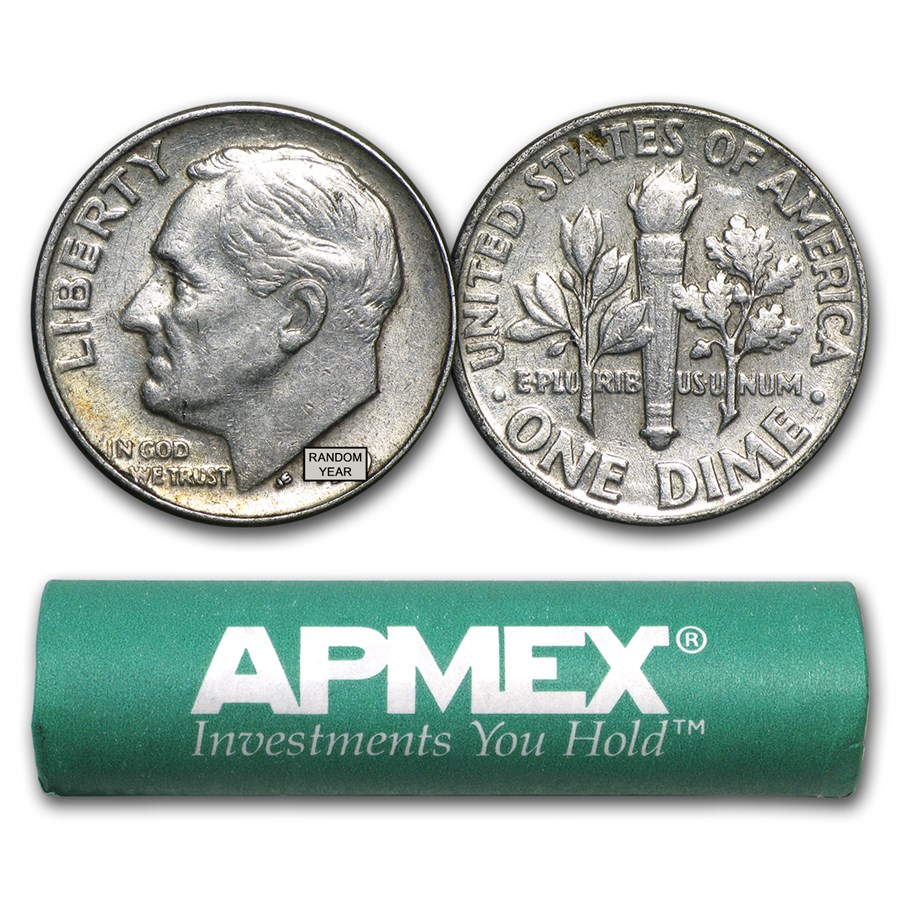

4. Junk Silver Dimes

These are U.S. ten-cent pieces and can offer a great opportunity for investment. The coins are from 1837 to 1964 that are made of 90% silver and 10% of copper. These small coins can add good value as a long term investment.

5. Junk Silver Quarters

Are Silver Coins Worth Money

These are U.S. quarter-dollar pieces that can have great value. The ones from 1932 to 1964 are occupied by 90% of silver, the other 10% is copper.

6. 2015 Blue Ridge Parkway Five-Ounce Silver Coin

This coin (not currently in circulation) is a great opportunity for those who are on a budget or who are just starting out in precious metals investments. It's an appealing coin that has familiarity to the silver coins used today. It features the Blue Ridge Mountains from Virginia and North Carolina. It's 99.9% silver and is great value for the price.

7. Silver Canadian Maple Leafs

This is a government issued coin that has an excellent .9999 of silver. It's very recognizable by many who know coins and has a unique design. This coin has legal-tender and is a great opportunity to own a coin with great craftsmanship and potential.

8. American Eagle 2015 One-Ounce Silver Uncirculated Coin

This silver coin can be a great option for a starting investment. It is 99.9% silver and has great value. It has the 'Walking Liberty' on it, a work of art. The coin can be one of the best silver coins to buy for survival.

9. APMEX 1oz Fine Silver Rounds

These rounds are very recognizable and have a high value. This coin has no legal tender but has the reasons to invest in it. APMEX is a business and their silver rounds have the potential for great return. They are typically called rounds since they are not issued by the U.S. government, so for legal purposes, this is their name. Either way, they are .999 silver and that's what counts. Visually, they don't have much detail but can still be a great opportunity for silver.

10. Austrian Silver Philharmonics

This is the silver coin that is denominated in euros. The coin features a meticulous design of instruments from the Austrian Philharmonic Orchestra. This is a national treasure of Austria that many adore, One side of the coin exudes the Golden Hall in Vienna.

Conclusion

If you are brand new to precious metals, it’s extremely important to commit to your due diligence, and investigate every element of what you are purchasing, as well as the economic forecast on how this investment will appreciate or depreciate in the next 20 years.

Thankfully, investing a portion of your capital in Silver is never a bad decision. Even in brutal market turmoil caused by COVID-19, silver will ALWAYS be in huge demand given it’s use in numerous consumer applications.

I definitely think you should purchase some silver now while the price is low. Wall Street Analysts predict that it’s the price could raise after the pandemic (or sooner).

Visit Money Metals Exchange and check out the silver coins they have available. This online seller is one of the most trusted and has a BBB rating of A+ and, best of all, they offer the lowest prices around. Click below to check out the silver coins in Money Metas Exchange.

Silver Coin Price Today In Kanpur

As an Investor (or future investor), you need to be in a position to forecast and predict market volatility before it happens.

If COVID-19 has taught us anything, it's that we need to prioritize diversifying our portfolios to prepare for future market turmoil.

Click here to discover the “unpredictable” Black Swan event that will bring our economy to its knees this year. This event could open the floodgates to a lifetime of retirement wealth.

For those who take advantage of it, the coming decade could return untold fortunes.

Best Silver Coin Prices

Using our silver coin values calculator couldn’t be easier. Simply enter the number of coins you have and the calculator will use the up to the minute silver value to calculate what the silver content of your coin(s) is worth.

Silver Coin Spot Price Today

Keep in mind that the way we determine your silver coin price is based purely on the content of silver in your coin(s) and the current value of silver, commonly referred to as the melt value. Obviously if your coins are in collectible condition they could be, and probably are worth considerably more.